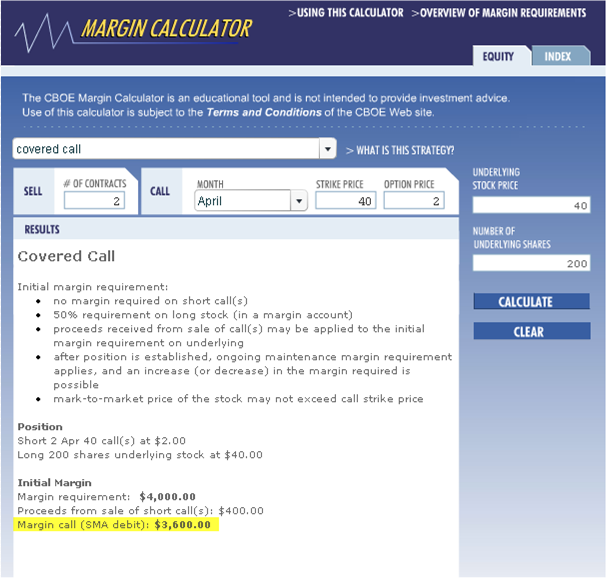

Covered call option margin calculator

In real estate investing, the concept of leveraged investing is well known and documented in such best-sellers as Robert G. The idea of generating profit while using little or none of your own money down is enticing and exciting.

Covered Call Calculator

It actually does make sense in certain scenarios. When it comes to the stock market, the use of options is a great example of leveraged investing.

The option buyer not us, the call seller is controlling shares of stock at a greatly reduced cost. There is another way to leverage our covered call investments and that is to trade in a margin account.

Covered Call Calculator - Option Market Mentor

This is a brokerage account where the client has the ability to borrow money from the broker to purchase securities. This loan is then collateralized by the cash and securities in that specific account.

Both gains and losses can be magnified via this form of leverage. If and when the value of the security drops to a certain level, the investor will be required to put additional cash in the account or sell certain securities.

This is known as a margin call. You are only allowed to borrow money to buy certain securities called marginable securities.

Margin Accounts and Covered Call Writing | The Blue Collar Investor

You cannot buy options on margin. However, when writing covered calls you can borrow money for the first leg of the trade which is the purchase of the security.

When money is borrowed from our broker in a margin account, interest is charged and needs to be calculated into our results. Example of margin in a covered call trade: Either way is correct as it is simply a different philosophical approach to the strategy.

Once a stock has been purchased on margin, the Financial Industry Regulatory Authority FINRA requires that you must maintain a minimum amount of equity in the margin account. Some firms may require more. Disadvantages of Margin Accounts: Margin accounts are a form of leverage which can magnify investment results dramatically in both directions.

Free Option Trading Calculator | Option Strategist

I would only advise the use of margin accounts when writing covered calls for experienced, savvy investors with a successful track record. I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Margin Accounts And Covered Call Writing Dec.

The Blue Collar Investor Corp. Investing Ideas , Options.

Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Alan Ellman and get email alerts.