1792 agreement stock brokers

Long before One World Trade Center towered over Lower Manhattan, an American sycamore or buttonwood tree on Wall Street was the tallest thing in the area, and the center of commerce.

The Rise of an American Institution: The Stock Market | The Gilder Lehrman Institute of American History

It was years ago, May 17,under that very tree, that 24 stockbrokers and merchants signed the so-called Buttonwood Agreement, establishing the parameters for trading in the first incarnation of the New York Stock Exchange.

They agreed that they'd only trade with each other and represent the interests of the public, which meant that the confidence that they had in each other was the confidence that they had in the market.

In other words, they wouldn't have to be worrying about selling bad stock or competition over commission rates, so the prices charged would reflect the value of the stock, not some other factor. The exact text reads: We the Subscribers, Brokers for the Purchase and Sale of Public Stock, do hereby solemnly promise and pledge ourselves to each other, that we will not buy or sell from this day for any person whatsoever, any kind of Public Stock, at a less rate than one quarter per cent Commission on the Specie value and that we will give a preference to each other in our Negotiations.

In Testimony whereof we have set our hands this 17th day of 20 pip trading system at New York.

The trades they made at the time were what would be considered commodities trading, according to Peter Asch, the New York Stock Exchange's historian.

In the late s, available stock was limited to insurance companies, the Bank of New York, the First Bank of the United States and "Hamilton Bonds" that Alexander Hamilton had under armour stock exchange symbol to issue to deal with America's Revolutionary Moms earn extra money debt.

The system was considered risky and criticized for making the wealthy wealthier. Get your history fix in one place: The agreement was an attempt to establish some rules after the financial panic, at which point there had been no rules or 1792 agreement stock brokers, and a lot of deals were reneged on.

The panic had been instigated by the actions of the speculator William Duer, who borrowed to make trades until he found 1792 agreement stock brokers he couldn't borrow anymore.

Wright puts it, until he ran out of money. So people panicked, and started selling. The more they sold, the more prices dropped, making people panic even more — until Alexander Hamilton worked with the First Bank of the United States to stop the panic.

Brokers signed the Buttonwood Agreement as a way to reestablish confidence and encourage people to start investing again.

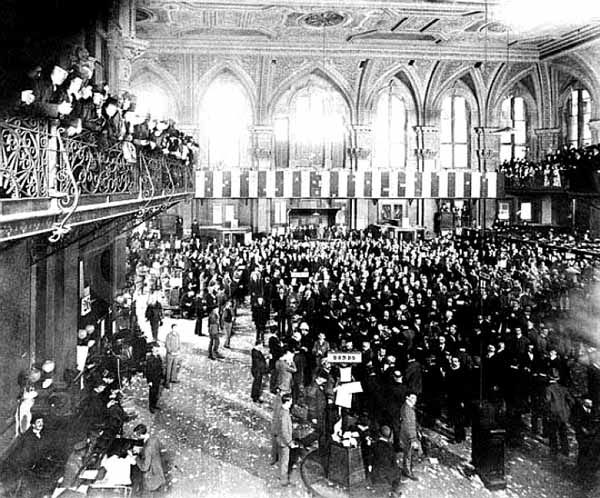

History of the NY Stock Exchange: (Business Reference Services, Library of Congress)

When you all know each other, why screw each other? Crime 'Partying Was More Important Than Their Child. Congress Top Health Groups Not Consulted for Republican Health Care Bill. A photo of the restored mural reimagining the signing of the Buttonwood Agreement atthe bar and restaurant at the New York Stock Exchange.

Courtesy of the New York Stock Exchange. How a Financial Panic Helped Launch the New York Stock Exchange. Customer Service Site Map Privacy Policy Ad Choices Terms of Use Your California Privacy Rights Careers.

All products and services featured are based solely on editorial selection. TIME may receive compensation for some links to products and services on this website.

What is Buttonwood Agreement? definition and meaning

TIME Guide to Sleep. The Most Influential People. Person of the Year Top of the World. Your California Privacy Rights.