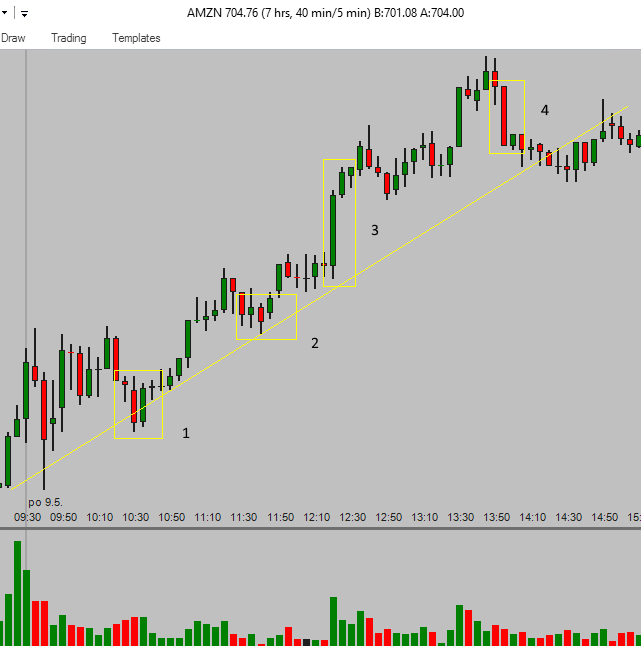

Candlestick charts for day trading

One of the most frequent questions I get regarding candlestick patterns is how to apply them to the day trading scenario. You have probably noticed by now, that many of the candlestick reversal patterns include a small gap somewhere in the pattern. This is fine on a daily chart, but when you are day trading, there is typically not a gap between candles because the market has not closed. Consequently, you will typically not see gaps in a forex chart except over the weekend.

In a similar way, you will not see gaps on a 5-minute chart that you may be day trading from. The patterns with gaps become patterns that do not have gaps, and some patterns that are obvious on a daily chart, become obsolete on an intra-day day trading chart.

Engulfing patterns are very popular because they are very good at predicting the next directional move of a stock. If you are trading on an intra-day chart also applies to forex and see this pattern in the right location at support , treat it like an engulfing pattern.

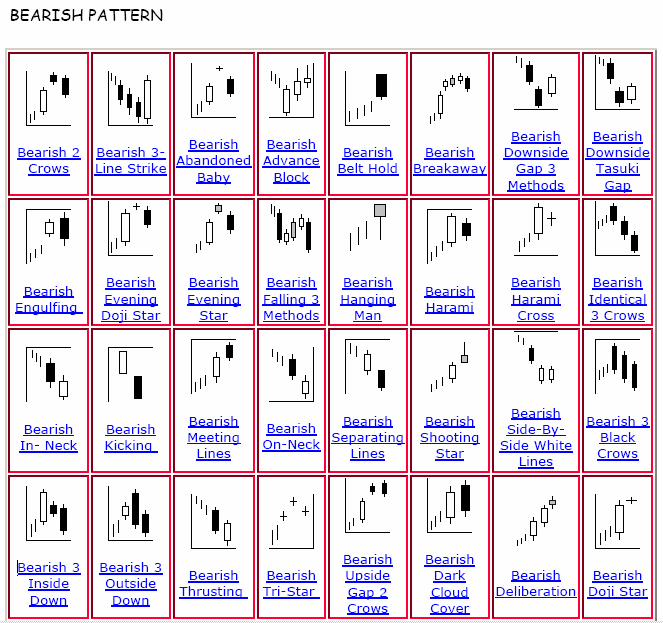

The odds are pretty high that it will play out like a traditional engulfing pattern. Need to learn candlestick patterns? Another very popular pattern for bearish reversals is the Dark Cloud Cover. This pattern is a highly predictable pattern that typically plays out as a bearish reversal when found at resistance. The Dark Cloud Cover becomes a challenging pattern intra-day because we can not have the opening gap. Instead, we classify it this way: You notice how small the distinction can be.

If it moves more than the full size of the candle, by definition we now have an engulfing pattern. On an intra-day chart, the Dark Cloud Cover and Harami are essentially the same pattern.

I would not suggest spending precious day trading time splitting hairs of how you name this candle. Similar to a traditional Harami, this pattern can work as a reversal, but it also can be equally neutral.

As such, it is definitely not as strong as an engulfing pattern and certainly not as strong as the traditional Dark Cloud Cover. Morning and Evening Star patterns are excellent reversal signals. Even though they both require gaps, the conversion to an intraday pattern is quite simple:.

One challenge that can confuse traders is the middle candle. The middle candle does not need to be either black or white, both work just fine.

But when there is no gap, it can create a slightly different looking image. Here are two variations of the same setup but with the middle candle alternating between black and white:. These two images look quite different because there is no gap on the intra-day chart. On a regular daily chart, the Morning Star is actually more clear, because of the gaps.

Yet, both of these iterations are perfectly legitimate as a Morning Star Reversal on an intra-day chart. The evening star is the exact same principle.

To identify an intra-day evening star pattern, just remove the expectation of the gap:. Morning Star and Evening Star patterns are excellent reversal signals in the traditional sense on a daily chart, and they are equally good on an intra-day chart.

In my experience, both of these patterns are probably the most reliable intra-day reversal signal. These are two patterns you should become very acquainted with and learn to recognize regardless of the time frames you tend to trade.

Tweezer patterns, in general, are the subject of controversy. Some people think they are great reversal patterns, some people think they are not. The challenge is not all of these patterns lead to good signals. This is a tweezer top or bottom where both candles are of similar size. More often than not when we find the above setups, the tweezer works as a very good reversal signal. Since the tweezer pattern does not require a gap, creating an ideal tweezer pattern on an intra-day chart is a non-issue, it is very easily accomplished.

If you look at all of the patterns we have looked at already, in a strict interpretation, they would each be classified as a tweezer. And now you can see the mystery of the tweezer as it applies to intra-day trading.

This is not a practical interpretation.

Introduction to Day Trading - Candlestick Charts

If we choose to ignore all tweezers on an intra-day chart, then we are left with nothing but a handful of patterns to choose from. This is probably the simplest solution. If we choose to only name truly Ideal Tweezers, then it may be of value because a truly ideal tweezer is a very good reversal signal intra-day.

Candlestick Charts Learn from the Master Steve Nison

If we take this latter approach, we can reduce intra-day 2 candle reversals to the following list of only 4 patterns:. In my opinion, simplicity is best. It must be exact to be an ideal tweezer. So does it really matter what we call it? At the end of the day, the only thing that matters is you know how to interpret the patterns. With these guidelines, you can easily make the adaptation of the gaps into intra-day patterns. You can now see there are really only 3 or 4, depending on how you count them.

To make the adaptation, simply remove the need for the gap. It is important to understand, everything I have just shared works on any continuous market. So any market that never closes, such as Forex and some Futures markets, will also benefit from the same interpretation I have shared with you here. Even if you have no plans of becoming a day trader, learning to recognize these subtle situational differences will make you a much better trader.

I highly encourage you to spend some time with this list, make your notes, and learn how to make the adaptations. Your trading will thank you one day. May 22, at 5: May 22, at May 23, at 6: Japan has opposite and or different meanings to the color of each candle on a candlestick pattern so in forex it must be interpreted differently to Japanese standards of colors.

May 23, at As always, you do a great job of making the complicated seem easy. Keep up the good job. Look forward to reading more articles. May 25, at 9: July 30, at 3: Because i am day trader, its kinda confuse because the definition in textbook mostly use for inter-day pattern. Your email address will not be published. The information presented on this website and through TradeSmart University, providing stock market trading classes and option trading education programs, is for educational purposes and is not intended to be a recommendation for any specific investment.

All stock market trading classes, options trading education, and courses are examples and references and are intended for such purposes of education. The risk of loss trading securities, futures, forex, and options can be substantial.

Individuals must consider all relevant risk factors including their own personal financial situation before trading.

Options trading involves risk and is not suitable for all investors. It is the official position of TradeSmart University to encourage all students to learn to trade in a virtual, simulated trading environment where no risk may be incurred. Students and individuals are solely responsible for any live trades placed in their own personal accounts.

TradeSmart University, it's teachers and affiliates, are in no way responsible for individual loss due to poor trading decisions, poorly executed trades, or any other individual actions which may lead to loss of funds. Toggle navigation TradeSmart University's Blog. General Analysis Trade For A Living TradeSmart University News Trade Ideas.

How to use candlestick patterns for day trading Posted by Jeremy Whaley on May 20, 6 Comments. So how do the patterns change? Engulfing patterns Engulfing patterns are very popular because they are very good at predicting the next directional move of a stock.

On an intra-day chart, simply remove the criteria for the opening gap.

Day Trading the stock market

As long as the 2nd candle closes above the first, we can call it an engulfing pattern. Again, the challenge is this pattern needs to have an opening gap! Even though they both require gaps, the conversion to an intraday pattern is quite simple: All we need to do is remove the gaps and it looks like this: Here are two variations of the same setup but with the middle candle alternating between black and white: To identify an intra-day evening star pattern, just remove the expectation of the gap: Technically all of these patterns below are tweezer patterns: So how should we approach it?

I suggest one of two approaches: If we take this latter approach, we can reduce intra-day 2 candle reversals to the following list of only 4 patterns: Please continue to do articles on day trading!! VERY USE FUL FOR TECHNICAL TRADERS.

Leave a Reply Cancel reply Your email address will not be published. Click below to Learn about: Recent Posts Do You REALLY Understand Stock Market Pricing? Archives June May March February November October September August July June May April March February January December November October September August July June May April March February January December MEMBERS AREA Register Login Technical Support.