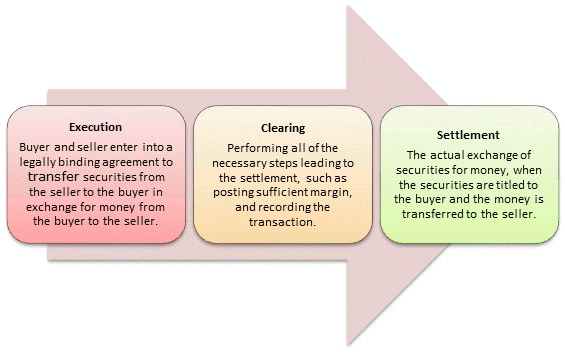

Clearing and settlement process in stock market

Please wait while loading Procedures followed for clearing and settlement of material securities: Ensuring that the security is valid for trading.

Trading procedure on stock exchange Class XII Business Studies by Dr Heena RanaReviewing and Checking phase Entered data is reviewed and matched with the previous phase. Then, certificate of ownership transfer is issued for the buyer. Owner verification test This test is run during settling financial positions of securities intermediaries. If any error is found in the relevant data, financial settlement will be disregarded. Procedures of purchasing securities through the central depository system: The client signs a purchase order at the brokerage firm or issues an order by phone or through the electronic trading system.

The securities broker registers the purchase order on the related automated system in order to ensure that the client has a contract with a custodian. The transaction shall be executed at the stock exchange through matching selling and buying offers.

The custodian accepts the securities purchased by the client provided that there is a contractual relation between the client and the custodian. Custodians When the transaction is executed, the custodian receives the daily trading transactions through the custodian program.

Upon receiving the transaction, the custodian verifies purchase orders with the executed transactions, issues transfer orders and sends them to the MCDR after ensuring that there is a contractual relation with the client. At the settlement date, statements of account indicating automatic addition to the brokerage companies will be delivered. The Custodian will print a statement of account for the client upon his request. Documents supporting the transaction will be filed purchase order — client ID.

MCDR Receiving daily trading transactions from the stock exchange Sending trading transactions, whenever received, to the custodians, brokerage companies and some of the clients using the MCDR services. Undertaking clearing and settlement of executed trades at the specified settlement date after ensuring the sufficiency of securities and cash settlement.

Procedures of selling securities through the central depository system First: The securities broker registers the sale order on the related automated system where a custodian makes an on-line approval if the securities balance is sufficient for the requested trade.

The system will also reject the trade if the balance of securities is not enough. The transaction shall then be executed at the stock exchange through matching selling and buying offers.

.: MCDR :.

The brokerage firm shall undertake the remaining procedures as agreed upon with the custodian to transfer the balance. Custodians Receive the sale order directly from the client or manually from the brokerage company or by fax. After executing the sale transaction, the custodian receives the daily trades through the custodian system then allocates the sale transactions. At the settlement date, and after making the settlement, the custodian prints out clients account statement that indicates the deduction of the securities from the available balance.

The custodian will also file the documents supporting the transaction, these are: Settlement of transfer order Receiving daily trading transactions of the execution day from the stock exchange.

ตลาดหลักทรัพย์แห่งประเทศไทย - สรุปภาพรวมตลาด

Undertake clearing and settlement after verifying the sufficiency of both securities and cash balances. M C D R Profile.

Most Active Issuing Companies List. Same Day Issuing Companies List. Settlement Guarantee Fund Rules. Clearing and Settlement Systems of Material Securities Definition The clearing and settlement system means identifying rights and obligations resulting from securities trading, covering the financial positions resulting from these transactions and effecting the relevant discount and addition as required.