Hedging instrument fx forwards

Please see our privacy policy. Be the first to comment. If you hedge a FX risk exposure, you are trying to establish a second currency position to offset what is lost or gained on the original exposure. The difficulty with hedging a translation risk exposure is that translation risk does not result in cash gains or losses, whereas most hedging transactions do. This month, continuing our series on translation risk, we look at the use of hedging instruments.

We explain what you need to consider and the options available. For an in-depth explanation of FX risk, see Treasury Today May For more information on translation risk specifically, see Treasury Today April For an in-depth explanation on different hedges, see June and September — December For this reason, many companies do not incorporate translation risk exposures into their hedging strategy.

If they do, typically the strategy will not be as extensive as one devised to offset transaction risk exposures.

Currency Forward

Nonetheless, it is unlikely that companies with complex structures — such as a multinational corporation whose local subsidiaries operate in their domestic currency — will operate successfully without some form of translation risk management. In order to manage translation risk exposures, some companies have to hedge. In order to determine whether — and to what extent — hedges should be used to manage translation risk exposures, a company needs to consider a number of factors.

If it is already high risk, this may affect any decision to hedge. If so, the exposure to translation risk may be considered too high not to hedge. Does it need to demonstrate a healthy balance sheet in order to secure funding? How will translation risk affect the balance sheet?

How will these affect the value and profitability of the company? Caution is needed when hedging — it not a straightforward practice. For example, there is a danger that by using hedging instruments, companies will achieve paper gains that offset cash losses.

It is important to remember that translation risk does not result in actual cash movements in the same way that transaction risk does. Therefore, companies need to think carefully before they embark on a strategy which increases their actual exposure to loss. A key balance — between uncertainty and the risk of cash losses — is crucial. Ultimately, whether and how much a company hedges translation risk exposure is a decision for the Board. Choosing the wrong strategy can cause even highly profitable companies severe problems.

If you decide to manage translation risk exposures by hedging them, there are a number of options available. There are two distinct groups of hedges — natural and transactional. A natural hedge eliminates the exposure without undertaking a specific hedging transaction. Instead, the natural needs of the business are used to undertake transactions which provide an offset to the transaction risk in the business.

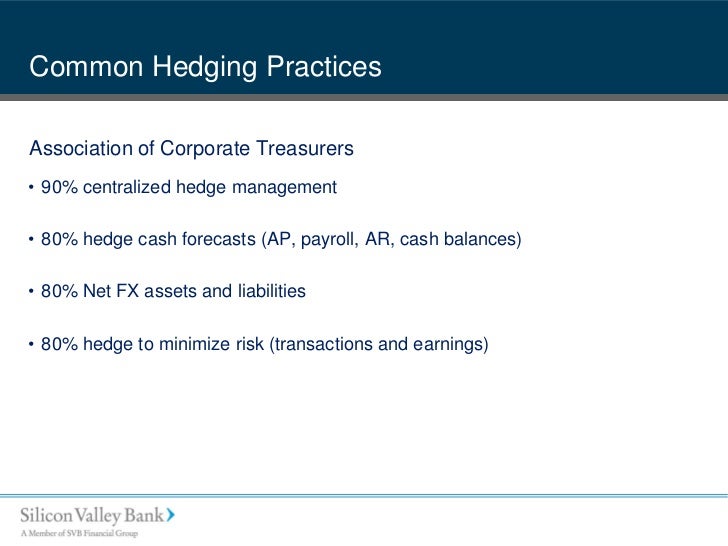

An example is where a company matches foreign currency assets with foreign currency liabilities. Natural hedges are used predominantly by companies with centralised treasuries who have up-to-date information on the assets and liabilities of all the operating companies — and therefore the ability to match values more effectively. It is less suited to companies with less centralised and complex structures.

Also, by hedging in this way, companies avoid the need of costly derivatives and, in turn, any SFAS and IAS concerns. However, natural hedges rely on being able to match foreign currency liabilities and assets, which is not always feasible. Classically, balance sheet hedging is achieved through matching overseas assets with borrowings in the equivalent overseas currencies. This means that assets are netted by liabilities, leaving a smaller net balance which is converted to sterling at the balance sheet date.

For more details please see www. A transactional hedge involves the company entering into an agreement that fixes the exchange rate on a given amount of money. The idea is to use the resulting gain or loss to offset the translation risk that has been identified.

Commercial banks sell transactional hedges and they are widely available in the financial futures markets and quoted on some stock exchanges.

An agreement between two parties to exchange a series of cash flows denominated in one currency for those in another, over a predetermined period. It involves swapping currency amounts for an agreed period and paying interest during that period. This gives the party buying the option the right, but not the obligation, to exchange a sum of one currency for an agreed sum of another.

The transaction must occur on or before a given date in the future. Where two parties fix the exchange rate between two currencies for a future date. Settlement, of an agreed sum for each currency, occurs on the specified future date. If a company does not have the option of using a natural hedge, a forward is often the most appropriate way for complex companies to hedge a translation risk exposure.

Take the following example. A foreign subsidiary has assets on its balance sheet in Euros. On balance sheet day, the Group translates the value of the assets in Euros into US Dollars for consolidated reporting purposes.

There is no physical transfer of cash during this translation process. The US headquarters may decide to hedge this translation risk exposure by entering into a forward foreign exchange agreement. On the balance sheet date, the forward foreign exchange agreement is settled.

Regardless whether the Euro appreciates or depreciates relative to the US Dollar over the three month period, the exchange rate is fixed. This is sometimes described as closing out the forward contract. The net difference received or paid in US Dollars will offset any change in the underlying net value in dollars of the subsidiary.

Transactional hedges have one main advantage over natural ones — the company can specify the exact amount it requires to cover the exposure. In comparison, natural hedges rely on being able to match assets with liabilities. In practice, this is difficult to achieve.

Of all transactional hedges, a forward contract is often the most preferred to hedge translation risk. It has the main advantage of being simple — fixing the rate of translation for the appropriate balance sheet date with the relevant forward rate.

The difficulty with transactional hedges is that specifying the exact amount is not easy because it can be difficult to predict the future value of an exposure. For example, do you know how much profit a subsidiary will make and retain in a foreign currency? Or how the value of foreign currency fixed assets will change? If the Euro has depreciated during the forward contract, the company will benefit from what will effectively have become a partly speculative contract. The reverse will be the case if the Euro has appreciated.

Currency Forward Contracts

Next month we will investigate accounting treatments in relation to translation risk hedges. Another disadvantage is that currency swaps, options and forwards all use derivatives — which can be a complication. The accounting for derivatives is covered by the new IAS 39 a standard introduced by the International Accounting Standards Board and, in the US, SFAS regulations introduced by the US Financial Accounting Standards Board.

We will look at how these affect the reporting of hedged translation risk exposures next month. Another factor to bear in mind when considering transactional hedges — whether using them for translation or transaction purposes — is that the availability of instruments will vary with currency pairs.

A derivative is a financial instrument used to hedge risk. It is not the same as buying the underlying investment. A derivative may require little or no initial investment and is settled at a future date. If a company takes out hedging transactions for translation risk exposures, there must come a point when the company closes them out — ideally when the change in value of the item being hedged is also being realised.

Hedges cannot last indefinitely. Jun Be the first to comment Related tags: Culture — how does the company deal with risk generally — does it have a risk-averse approach or is it open to risk? Structure — does the company have a large number of overseas subsidiaries, operating in different and perhaps even volatile currencies? Capability — does the company have the resources in terms of expertise and capacity to manage hedges or the ability to outsource the management of hedges?

Value — how do shareholders and investors assess the value of the company? Competition — is the competition hedging translation risk exposures? Cash dependency — how dependant is the company on future cash flows? Example Consider this real life example of how natural hedging works for Vitec Group.

Example Take the following example. Derivative A derivative is a financial instrument used to hedge risk. Remember me Forgotten your password? Webinars Cash pooling — an introduction Adam Smith Awards Winners Tools. Is cash management sending you to sleep?

Amazon wants to replace passwords with selfies Bankers banned from Parisian brasserie more