Stock option vesting period

Stock Options are a popular way for companies, especially startups, to compensate their employees. The most important things to understand are covered in this post: A contract sets out the terms, which include number of shares, vesting schedule, exercise price, and expiry date. One of the biggest caveats about stock options are the tax implications when it comes to exercising them, which we discuss in some detail below.

Once this period has passed and you have exercised your options, you will own the shares just as you would if you had bought them like any other investor. There are different types of options you may be offered, so check your agreement to figure out which one yours fall under. You are given the option to purchase shares of the company at a predetermined price. Employee stock purchase plan ESPP: You can acquire shares at a discounted price that is less than the market price at the time of acquisition.

Most ESPPs require you to work for the company for a certain amount of time before you can acquire the shares. This happens when your exercise price is higher than the current market price of the shares. During times of stock market volatility, employees of publicly traded companies may be allowed to exchange underwater options for those that are in money — since the company is legally allowed to cancel the first option grant and issue new options exercisable at the new share price.

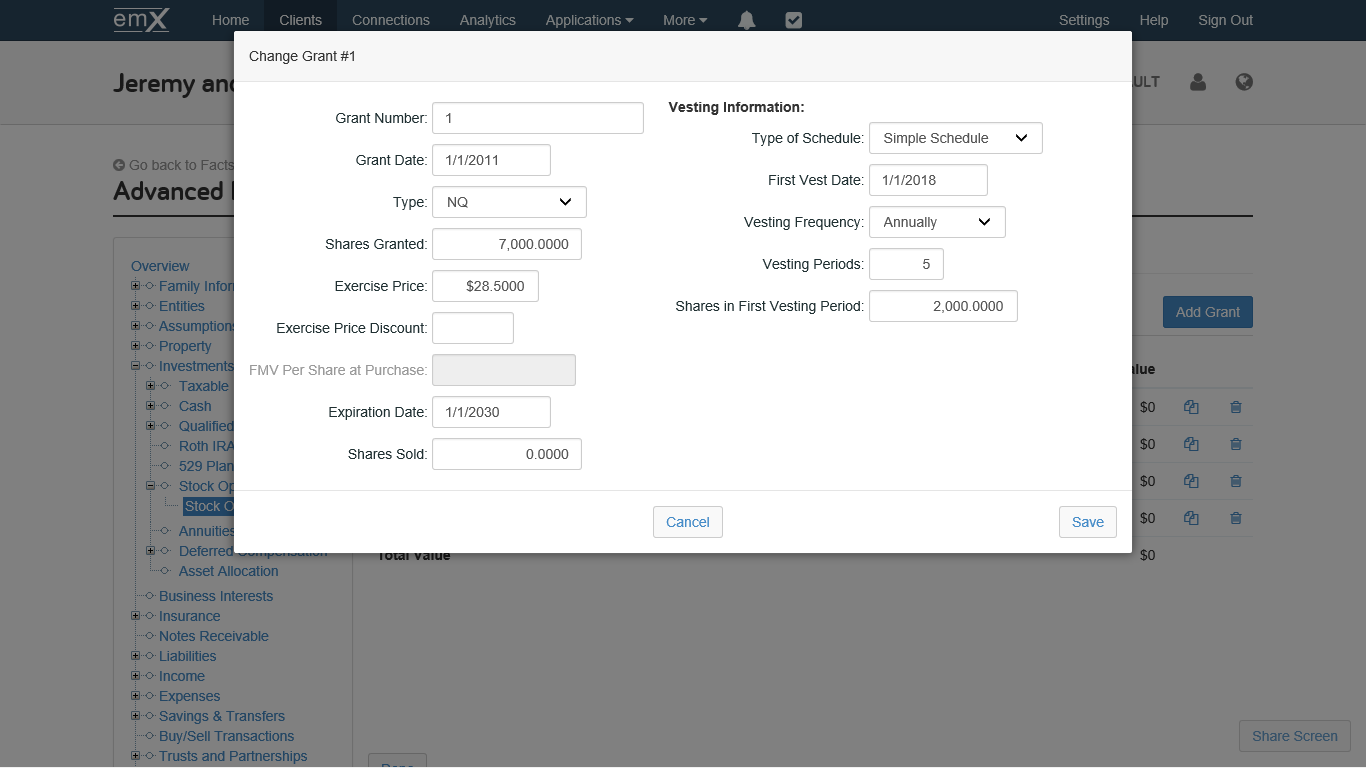

Vesting

Your company will determine what type of vesting period you have. By knowing how the vesting period works, you will be able to figure out exactly how long you need to wait before you can exercise your options. To add to the complexity, there are also two ways they may vest: When the option grant vests all at once, i.

When the options grant vests in a series of parts over time i. This is typically seen in early stage startups. A combination of time-based and performance-based vesting periods. The most common period is 10 years from the date of grant.

So, if you have a 4 year vesting period and the expiry period is 10 years, then you will have 6 years left to exercise your options after your vesting period. Make sure you exercise your options before the expiration of the grant term. If you do not, you will permanently forfeit them.

Understanding the tax implications of owning and exercising your options is essential to ensuring that you keep as much of the money generated by your options as possible. The difference in the exercise price and the fair market value FMV on the date the options are exercised is taxed as employment income.

Any gains or losses are treated no differently than if you purchased the shares on the open market. The FMV of the shares on the exercise date becomes the cost base for your shares. If your company is a CCPC Canadian-controlled private corporation , the taxable benefit you realize when exercising the options can be deferred until you sell the shares if you hold the shares for at least 2 years before you sell them.

Unlike with public companies, the exercise price and the FMV on the grant date do not have to be equal. CCPC shares are often eligible for a lifetime capital gains exemption LCGE , meaning you pay no tax on any gains up to that amount.

In order to qualify for this exemption, the company must be a CCPC when you sell the shares. If your company is going public, make sure you file the appropriate form T with CRA to make a deemed disposition of some or all of your shares as of that date. Make sure that the exercise price on your options was equal to the FMV on the grant date. Unlike for CCPCs, the taxable benefit cannot be deferred, it is taxable in the year the options are exercised. Also, the LCGE does not apply to public company shares.

If you leave before the vesting date, you will either have to forfeit your options, or will have a short time period typically 60 — 90 days to exercise. In other cases, when major job or life events occur such as disability or retirement, certain rules may be triggered under the plan.

With an IPO, nothing changes with regards to your actual stock options vested or unvested other than the shares you can buy with them are now easier to sell. If the company is bought, your stock options will likely carry forward — exactly how they do so will be determined by the transaction on a case-by-case basis.

In most scenarios, your options should be treated similarly to common shares. Refer to the tax section above to review the tax implications of private companies going public companies. Usually if the company is still private, it is difficult to determine the fair market value of any shares to be received on exercise of an option.

The value will be a best guess based on the last round of investment, or a valuation agent will determine the value of the company. Any sale in this situation may be subject to a right of first refusal.

This means your company or any one or more of its shareholders have the right to purchase the the shares at the price that was offered to you — or in some cases, a different price. In other words, you can use the difference between the market value and the exercise price as a way to exercise the option.

Once your options have vested, try not to succumb to the desire for instant gratification and jump into exercising and selling your shares. In the long-run, it can be a mistake and your actions should be dictated by your stock option strategy. An important consideration to make when you exercise your options is to think about the affect they will have on your overall asset allocation if you currently have an investment portfolio.

If you are in a senior position with the company, a limit that low may not be practical. An experienced financial advisor can help you manage the risk of a concentrated stock position.

RSUs Restricted Stock Unit are sometimes given instead of stock options. However it is unique in that it does not have an exercise price. This usually means that you do not own the RSUs until the vesting period the same as the vesting period on stock options has been met. At this time, they are assigned their current market value and are considered income. You then receive the remaining shares and can sell them whenever you like. So, if you were granted 10, RSUs, you do not own these shares until the company hits a defined performance condition, such as an IPO.

Once that defined period is hit, the company will deliver the 10, shares or cash equivalent of the number of shares. Amber is a content contributor at ModernAdvisor.

When she's not writing about personal finance, saving money and investing, she's coding, hiking or training for her next fitness competition. Reach out to her at ambsvan. Thank you for this post!

My employer has just announced that they will be offering a stock option plan to all employees and I was looking for information on this topic in advance of our information session next week.

I definitely feel better equipped now. We're not suggesting that government is big or bad. Why is the government "big, bad"? Are all you financial My employer has just announced Pricing Fee Analyzer About Us Pricing Team Careers Methodology ETFs We Use Resources Fee Analyzer RRSPs FAQ Blog Open My Account.

ModernAdvisor Blog Guiding you along your financial journey. All Investing Personal Finance Updates. How To Understand Employee Stock Options and Maximize Financial Gain By Amber Spencer August 28, ModernAdvisor is the smartest way to reach your financial goals Try investing now with an account funded by us.

Start my risk-free trial. Amber Spencer Amber is a content contributor at ModernAdvisor. Zipcar vs Car2go vs Used Car. Protect Your Portfolio With International Investments. Knowledge is power Subscribe to our newsletter to get market updates and investing tips. Popular Recent The Easiest Way to Save Money Every Month Oct 14, Zipcar vs Car2go vs Car Ownership: Is Carsharing Worth It? Market Update for May — Are ETFs WMDs?

Market Update for April — Are GICs still safe? Market Update for March Apr 19, Navid from ModernAdvisor on Why your Tax Refund is Bad News We're not suggesting that government is big or bad. Lyne B on How To Understand Employee Stock Options and Maximize Financial Gain Thank you for this post! About Us Team Careers Methodology ETFs We Use Responsible Investing Pricing.

Resources Fee Analyzer RRSPs Trial Accounts Investing Blog Engineering Blog FAQ. Legal Terms of Use Privacy Policy. Contact Office West Georgia St Vancouver, BC Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance.

Vesting - Wikipedia

All securities involve risk and may result in loss. We do not provide financial planning services to individual investors. Modern Advisor Canada Inc.