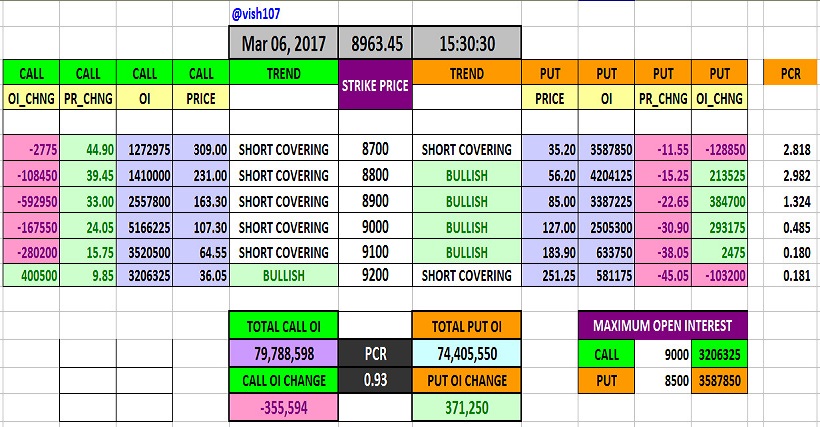

Put call ratio analysis nifty

By Bhaveek Patel 3 Comments. Before explaining you put call ratio analysis, I will tell you most important fact about options trading it is: How it is used in Technical Analysis: Now suppose if Put call ratio is 0.

This is because large traders are betting that nifty future may correct in near term. If you want to learn technical analysis online then just visit here.

Share/Stock Market & Technical Analysis Training, Program and Courses in Mumbai | BSE, Nifty, MCX Classes - Tips2trade

Bhaveek Patel is technical analyst and investor, his areas of interest includes stock market, forex and gold. March 31, at I have a doubt about Put call ratio.

Put/Call Ratio, PCR Analysis, Put-Call Ratio Technical Analysis, Nifty PCR Calculator, Nifty Put/Call Ratio Calculator, Put/Call Ratio Screener

Why do we infer it in contrary to this? September 2, at 3: So, with PCR understanding comes the contrarian view or opposite views. October 4, at 7: Your email address will not be published.

Technical Analysis - Put call ratio, VIX, TRIN, Margin Debt, Short Interest ratioNotify me of followup comments via e-mail. You can also subscribe without commenting.

About Us Contact Us Privacy Policy Disclaimer. OurNifty is Powered by Wordpress and hosted on Hostgator VPS. Trading Account Downloads Seminars Nifty Trend Finder Disclaimer Contact Us About Us Learn Technical Analysis.

Advanced Fibonacci Calculator | Nifty Technical Analysis

Forex Gold Intraday Stocks Midcap Stocks Multibagger Nifty Nifty Option NSE Amibroker. You Should Read This: Using Put Call Ratio to Trade Nifty Options High Accuracy Put call ratio is a ratio of total traded put option against call option for a given day. This is actually contrarian indicator for near term trend, on this indicator a reading above 1 will Trading Nifty Options Call Put with Levels of Nifty Future Chart Nifty future involves more risk as compared to nifty option call put , most of the traders as attracted towards nifty options.

Nifty options trading idea for next week, Buy more call options Nifty future continued its uptrend even after the financial budget was announced on 16 March , traders will be looking for buying opportunity on nifty future or nifty call options is large quantities.

Shall I Buy Nifty Call Options, Nifty Trading Higher Today Nifty future is trading higher by about points and we believe this up move will continue till nifty reaches a resistance level, So it would be better if we trade nifty options. Nifty options is shorted when a trader believes that option is going to expire worthless, About Bhaveek Patel Bhaveek Patel is technical analyst and investor, his areas of interest includes stock market, forex and gold.

Comments Amit Dewan says March 31, at Leave a Reply Cancel reply Your email address will not be published.

Nifty Future Chart Analysis this Week, Short Covering Ahead Next Post: How to Analyse Nifty Future Charts in Live Markets.

Subscribe for Free Updates. Recent Articles Penny Stocks List Traded in India on NSE for Stocks for intraday trade for General Budget — 17 Positional Trading with Nifty Options Live Open Interest Live Nifty Options open interest in Excel sheet Nifty Options trading strategy for Budget Session Trading Holidays list for NSE, BSE, MCX and NCDEX Stocks for Intraday trading: HDIL, DLF, LUPIN, JSWENERGY.

Popular Categories Amibroker Forex Gold Intraday Stocks Midcap Stocks Multibagger NEWS Nifty Nifty Option NSE Short Term Stocks Technical Analysis.