How do mortgage reits make money

REITs need capital, just like any other corporation.

The way a publicly traded REIT real estate investment trust does that is by IPO -- initial public offering. This is just like selling any other stock to the public, who are investing in the corporation's income-generating real estate.

The people who buy IPOs are investing in real estate which is managed like a stock portfolio. These external funds that raise capital enable the REIT to buy real estate, develop and manage it, for the purpose of generating profits.

REITs generate income, and 90 percent of that taxable income must be distributed to the shareholders on a regular basis. REITs make money from the properties they purchase by renting, leasing or selling them. The shareholders choose a board of directors, who are the ones responsible for choosing the investments and for hiring a team to manage them on a daily basis.

Guide to Mortgage Real Estate Investment Trusts | Mortgage REITs

The way REIT profits are usually measured is called FFO, which stands for funds from operations. The NAREIT calculations of net income are based on GAAP -- generally accepted accounting principles. The problem is that in GAAP calculations, the depreciation of assets is assumed to be a predictable given, which actually skews the true measure of a REITs revenue in a negative way because real estate, which is what REITs deal in, retains its value or how do mortgage reits make money increases over time.

For this reason, FFO does not include depreciation in the net practise investing stock market philippines. Investors who want an accurate calculation of a REITs FFO, must look to other sources, such as a company's quarterly report and other supplemental information.

The formula for measuring a REITs operating cash how do mortgage reits make money based on net income calculated according to GAAP is not always accurate. The true measure of a REITs FFO should also take into account factors such as repairs, maintenance and other costs.

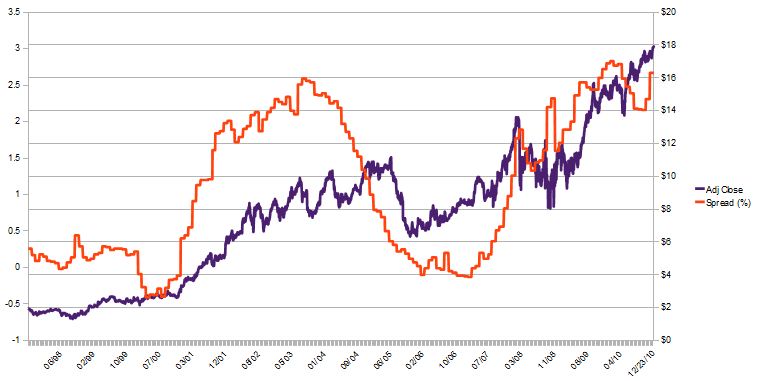

Why Mortgage REITs Are Only for Those Willing to Risk - TheStreet

Why is Ayn Rand So Popular Today? Why Using the Term 'Dry Drowning' Could Do More Harm Than Good. Air Force Dropped an Atomic Bomb on South Carolina in How to Keep Your Windows Spotless when the HOA Won't.

How Motion-Activated Screwdrivers Work. Is stainless steel really impossible to stain?

Follow us Facebook YouTube Twitter Pinterest. How does a REIT make money? How the First-time Homebuyer Tax Credit Worked.

Do you have to get a home value appraisal? How do we rebuild communities in the wake of the foreclosure crisis? What's a short sale, and why can they take longer to close?

About Shows Privacy Ad Choices Terms. Store Advertising Careers Contact Us Help. Keep up to date on: Testing this long verbose error message to check the behaviour.