Dealing desk vs non-dealing desk forex

We use cookies to give you a better online experience. By using our website you agree to our use of cookies in accordance with our privacy policy. On dealer forex trading platforms, the dealer knows your open positions, trading style and tactics and can use this information to his advantage.

On the FXCC ECN, you can trade instantly on prices streamed by leading Financial Institutions.

Dealing Desk vs. No Dealing Desk Forex Brokers | DailyForex

Re-quotes are common in traditional spread trading. FXCC does not re-quote.

Dealing Desk vs. No Dealing Desk Forex Brokers - qyzofolawory.web.fc2.com

FXCC allows all clients regardless of forex trade size to trade and put in new orders during key economic releases. Whatever type of trader you consider yourself to be: Traders should always, irrespective of their trading experience, approach the discipline of trading with the utmost diligence and professionalism. The type of broker you choose is a critical decision, which will have a profound impact on your potential success.

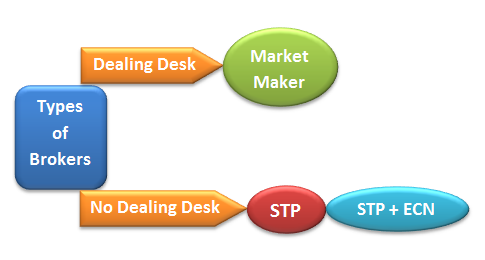

Should you choose a dealing desk broker, or a no dealing desk broker?

It is a straightforward choice and question, and one we will answer immediately. Firstly, the majority of FX traders are day traders or scalpers - whose trades can last from seconds, minutes, or hours these FX traders rarely hold FX trades overnight. Dealing desk traders "make the market", their own market. They are at liberty to quote their own synthetic price depending on a list of their variable conditions which could include how thin their liquidity is, based on the volume of business they are conducting on behalf of their customers.

Therefore their quotes are artificial quotes. However, traders may experience slippage and poor fills, meaning that the reality is they are being filled so far from the true market price that the spread is closer to two, or three pips per transaction.

The dealing desk broker can also delay filling the order in an attempt to get the best price for the broker. If the dealing desk client wins then the broker loses, they are effectively betting against the client.

Now whilst an argument could be put forward that with huge volumes the dealing desk broker is neutral in terms of the outcome, the fact remains that a dealing desk broker is taking a position looking to profit if the client loses.

Traders pay a small transaction fee per trade and there is generally no commissions charged. The trader gets straight through to the market via the electronic configured market place with no barrier, no interference and no intervention. The prices come from the network, a liquidity pool created by the contributors.

Occasionally these quotes can be incredibly good value, as low as a small percentage of a pip, perhaps 0. This can be crucial to your timing, particularly if you are a manual trader, who will weigh up the trading opportunity versus the level of activity in the market, before placing the trade.

Trading in Forex and Contracts for Difference CFDs , which are leveraged products, is highly speculative and involves substantial risk of loss. It is possible to lose all the initial capital invested.

No Dealing Desk

Therefore, Forex and CFDs may not be suitable for all investors. Only invest with money you can afford to lose.

No Dealing Desk

So please ensure that you fully understand the risks involved. Seek independent advice if necessary. Home about Why FXCC What is ECN?

Why FXCC What is ECN? Dealing Desk Our Business Model Regulation Company News Equinix Data Centre Risk Disclosure Client Money Protection Careers. Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe. Feature ECN Trading Model Fixed Spread Broker Platform Explanation Anonymity On dealer forex trading platforms, the dealer knows your open positions, trading style and tactics and can use this information to his advantage.

Client-To-Liquidity Trading On the FXCC ECN, you can trade instantly on prices streamed by leading Financial Institutions.

Re-quotes Re-quotes are common in traditional spread trading. Trading During Economic Releases FXCC allows all clients regardless of forex trade size to trade and put in new orders during key economic releases.